Your Money

Using your phone to pay is convenient, but it can also mean you spend more

Using your phone to pay is convenient, but it can also mean you spend more

4:10

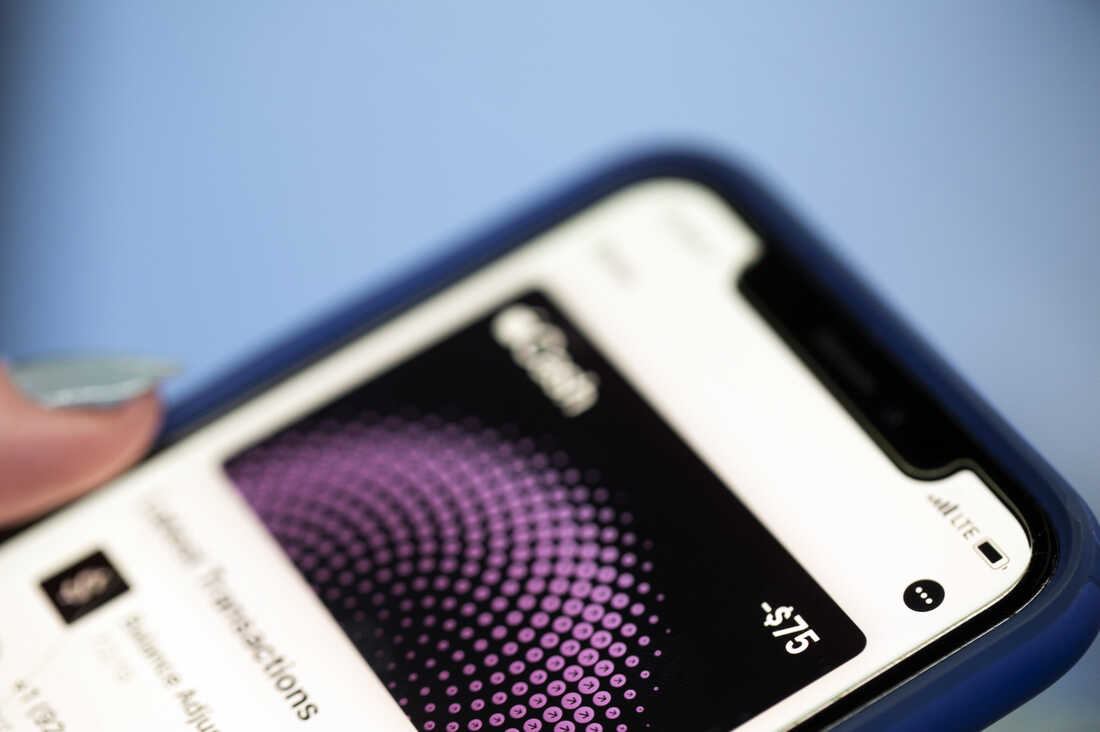

The Apple Pay app on an iPhone in New York. Consumers tend to spend about 10% more when they adopt mobile contactless payment methods, a researcher says.

Jenny Kane/AP

hide caption

toggle caption

Jenny Kane/AP

The Apple Pay app on an iPhone in New York. Consumers tend to spend about 10% more when they adopt mobile contactless payment methods, a researcher says.

Jenny Kane/AP

These days, you don’t even have to take your credit card out of your wallet in order to buy something. If you are shopping online, you can store your credit card numbers on your computer and just hit “click to pay.” In a store, call up Apple Pay or Google Pay on your smartphone and tap it against the payment terminal.

There’s a term now for this type of purchase: frictionless payments. And it might make spending money a little too easy for some people.

In a recent paper based on data from a Chinese bank, researchers found that customers charged 9.4% more on average to their credit cards, through both online and in-person transactions, after they adopted a mobile payment method than they had before.

The paper does not explore the effects frictionless payments are having on credit card debt. But the paper’s lead author, Yuqian Xu, an assistant professor at the Kenan-Flagler Business School at the University of North Carolina at Chapel Hill, told NPR she believes they probably play a significant role.

Given the paper’s findings, and surveys showing that about half of the U.S. population uses mobile payments, Xu estimates that approximately 4.5% of total credit card usage in the country is due to the influence of frictionless payments. That means, she calculates, that about $50 billion of the $1.13 trillion in current consumer credit card debt can be attributed to the ease mobile payment apps present.

Here are other excerpts from an interview with Xu, edited for brevity and clarity.

You did this research with a Chinese bank. Would you say that the way people use mobile payments in the U.S. likely follows a pretty similar pattern?

Yes. A fundamental mechanism here is the convenience that mobile payments bring to consumers. Therefore, we would expect that the effect would be similar in the U.S. mobile payment market.

It takes about 40 seconds to buy something with a physical credit card, compared to just 30 seconds to buy it with a smartphone. Can just 10 seconds make people change their buying habits?

The main reason underlying the increase in usage is convenience. And the convenience manifests in two primary ways. This swift transaction process contributed significantly to the overall convenience experienced by users. But there’s another part of the convenience derived from the absence of the need to carry additional physical cards or a wallet.

What about yourself? Do you find yourself using your phone more often than you would a credit card?

Yes, I do find that actually. In the past, I tended to forget to bring my physical cards. And this actually sometimes created a barrier to buy things. But I don’t tend to forget my mobile phone. I bring my mobile phone every day. So I find I purchase more with mobile payments.

Do you have any tips for people who want to control their spending? Should they avoid these mobile payment apps?

I would say, don’t avoid these mobile payment apps. Technological advancements can offer us a lot of convenience and improve the security of financial transactions. What’s most important is that people need to be aware of these dynamics — we can better manage our financial resources, potentially reducing impulsive expenditures.

Michael Radcliffe produced this interview.